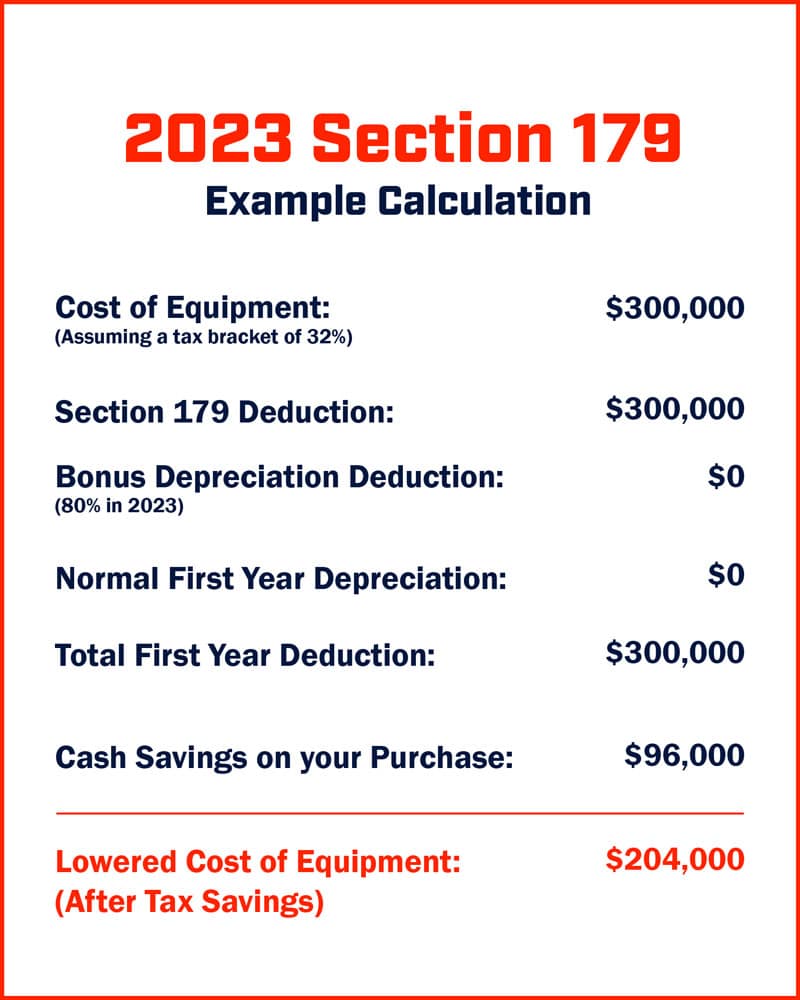

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE (up to $1,160,000) from your gross income. It’s an incentive created to encourage businesses to buy equipment and invest in their business.

Here’s how it works:

Bonus Depreciation

Bonus Depreciation allows taxpayers to deduct a % of an asset’s cost up front. Bonus Depreciation begins to phase down starting in 2023:

- 2023: 80%

- 2024: 60%

- 2025: 40%

- 2026: 20%

Calculate What You Could Save with Section 179 & Bonus Depreciation Incentives!

To better understand the significant impact that Section 179 can have on your new equipment purchase, try the Section 179 calculator:

Need more information?

Don’t let this tax incentive slip by. Machinery must be purchased and delivered by December 31, 2023 so don’t delay. Consider machine delivery lead times to ensure you don’t miss out on these tax incentives.

Consult your tax advisor for more details regarding Section 179 Deduction or visit the official Section 179 website.

Adding the right machinery provides real results. Understand the impact at these shops.

Adding the right machinery provides real results. Understand the impact at these shops.