Financing & Tax Incentives

Learn how equipment financing can support your next machine investment with flexible options, potential tax savings, and guidance from the experts at Park Industries® every step of the way.

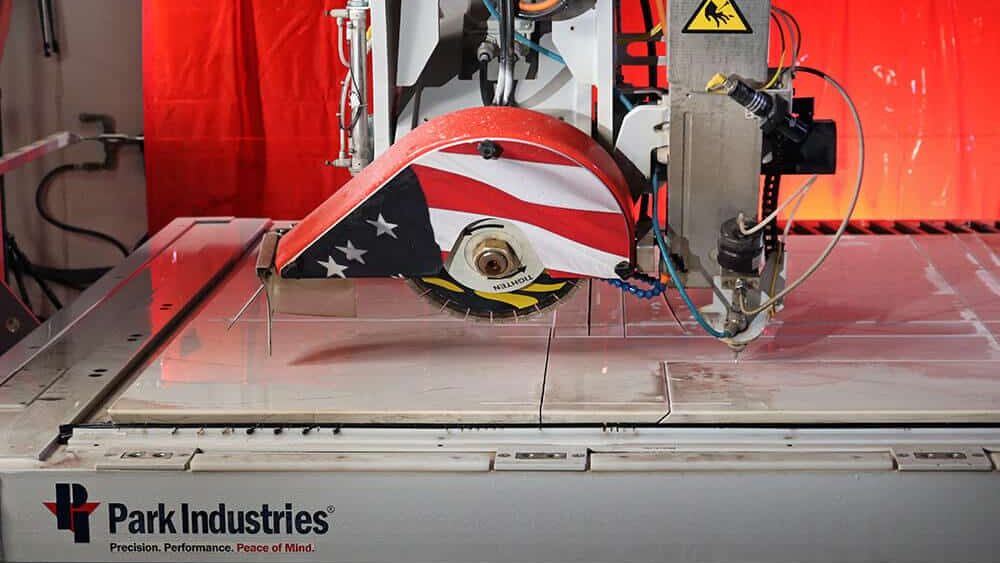

At Park Industries®, we understand that purchasing stone fabrication machinery is a major investment, and financing can play a key role in making it happen. From maximizing tax incentives to choosing options that align with your business goals, the right approach can position your shop for long-term success.

Explore how smart financing strategies, tax advantages, and trusted support can help you move forward with confidence.

Explore Your Financing Options

Whether you prefer to lease, work with your bank, or pay with cash, there’s a path that fits your business. Here’s a quick overview of the most common options fabricators choose:

Leasing

Leasing Park Industries® machinery (capital equipment) through a financing company is a great option for a variety of reasons today.

Preserves Working Capital

Leasing requires little or no cash outlay. You may also be provided 100% financing.

Preserves Lines of Credit

When you decide to lease, you don’t have to worry about your organization’s line of credit. Leasing will not have an impact on the availability of your organization’s credit.

Fixed Payments

When you decide to lease equipment, you can count on fixed lease payments. They’ll be fixed for a specific period of time, and you won’t need to worry about annual adjustments.

Flexible Terms

Leasing means that lease terms can be structured to meet your individual needs. We offer $1 buyout options, step payment plans, 60- and 90-day deferred payment plans, a capped FMV Option Lease, fixed purchase options, and tax leases.

Tax Benefits

When you lease business equipment, businesses may deduct the cost as a necessary business expense and receive tax benefits.

Buying With A Bank

If you already have a great working relationship with a bank, you may choose to finance your new equipment by taking out a loan with your bank.

Get Pre-Approved

You may choose to apply for a loan through your bank before you begin shopping. With pre-approval in hand, you’ll be able to make your purchase on the spot.

Relationships with Bank

You may already have a relationship with a bank because the business has worked with them for years or you’ve taken business loans out with them previously. Taking out another loan with the bank may be easier because of this. You might find that qualifying for financing is easier because of the working relationship you have with the bank.

May Reduce Lifetime Cost

If you have a good relationship with the bank, and you’ve taken loans out with them before, not only may it be easier to qualify for another loan, but you may get a better interest rate. This equates to the potential for not only a lower interest rate, but lower payments or a shorter loan term.

No Collateral Needed

You may find that, because the equipment you’re investing in can be used to secure the loan, you may not need to provide collateral for the loan.

No End-of-Term Buyout

Again, because the loan is secured by the equipment, the business won’t need to worry about buyout at the end of the term. You won’t need to worry about returning the equipment after a certain period of time.

Paying Cash

If you don’t want to take out a loan with your bank or lease your new equipment, you always have the option of paying upfront with cash.

Saves Money on Interest

When you buy a machine on the spot, you don’t need to worry about paying extra interest fees. You’ll only be paying for the cost of the machine and taxes. This will save you money.

Free Credit for Other Needs

Because the machine is paid for, you don’t have to worry about freeing up credit for other large purchases.

Instant Ownership

When you pay on the spot, you’ll own the machine immediately. No need to concern yourself about leases, loans, or contracts. The equipment is yours.

Tax Benefits

Come tax season, you’ll receive a tax benefit for purchasing the machine, as it is considered business equipment.

Stay on Budget

Because you are paying upfront, and you don’t have to worry about interest, you may find that it’s easier to stay within your budget.

Take Advantage of Tax Incentives

Smart financing decisions can lead to significant savings, especially when paired with tax benefits.

Section 179 Deduction

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment that is purchased or financed and put into service during the tax year. That means you can invest in machinery and deduct up to $1,250,000 from your taxable income.

Machinery must be purchased and delivered by December 31, 2025 to qualify for the current tax year.

Bonus Depreciation

In addition to Section 179, Bonus Depreciation lets you deduct a percentage of an asset’s cost upfront:

2025: 40% — 2026: 20%

Calculate YOUR SAVINGS

To better understand the significant impact that Section 179 can have on your new equipment purchase, try the Section 179 calculator:

Need more information?

Don’t let this tax incentive slip by. Machinery must be purchased and delivered by December 31, 2025 so don’t delay. Consider machine delivery lead times to ensure you don’t miss out on these tax incentives.

Consult your tax advisor for more details regarding Section 179 Deduction or visit the official Section 179 website.

“I take advantage of these tax incentives annually. Rather than paying taxes, I purchase equipment that reduces my payroll hours AND I get to take a large first year depreciation, sometimes the entire purchase price of the machine – the tax savings are huge!”

– Montana Customer

Have Questions about Financing Options?

We’re not just here to sell a machine. We’re here to be your partners and help your business grow. We’d be happy to assist in finding the right financing option for you.

With 70+ years of experience helping fabricators succeed, we understand the ins and outs of cash flow, profitability, and the importance of making the right investment at the right time. Our team takes a consultative approach, helping you weigh options and choose the best fit for your needs.

If you’re ready to start the conversation, connect with a Park expert and let’s explore the possibilities together.

Let’s Find Your Next Machine

Have questions? Need help deciding? Our team is ready to guide you.